Corporate Governance

Basic Stance

Based on our management philosophy, "Helping customers realize their dreams and happiness by offering the highest-quality guarantee instruments and services to all customers who need credit guarantees, and contributing to the development of regional communities through our credit guarantee service business," we respond to the mandate of our stakeholders by fulfilling public duties and social responsibilities as a credit guarantee company focused on housing loans. To ensure transparent and fair decision making and enhance corporate value in the medium- to long-term, we will further enhance corporate governance based on the Basic Policy on Corporate Governance, which sets forth our basic stance on corporate governance, in light of the ideas behind the principles of Japan's Corporate Governance Code.

Basic Policy

We have established a Basic Policy on Corporate Governance that sets forth our basic stance on corporate governance in light of the ideas behind the principles of Japanʼs Corporate Governance Code.

Corporate Governance Report

ZENKOKU HOSHO's corporate governance report, which was submitted to the Tokyo Stock Exchange, is available from the following link.

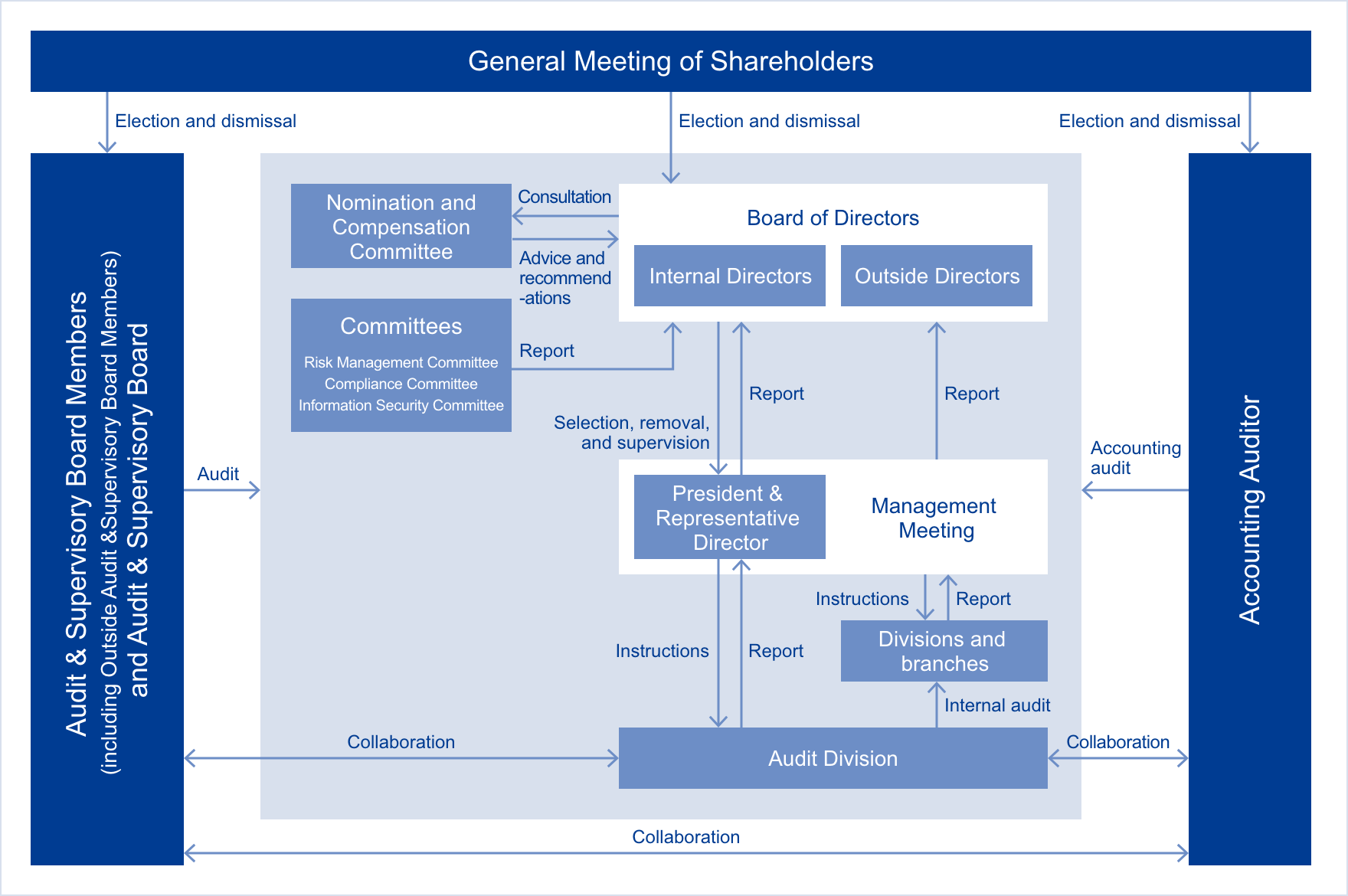

Corporate governance system

Board of Directors

The Board of Directors of ZENKOKU HOSHO (hereinafter the "Company" or "we") consists of seven Directors, three of whom are Outside Directors, and resolves basic policies and important matters concerning business execution. Meetings are held monthly, in principle, and also when necessary.

The Board of Directors makes decisions on matters designated by law, matters delegated under the Articles of Incorporation, and matters delegated under the resolution of the General Meeting of Shareholders. The Board can also entrust the Management Meeting or specialized committees with the resolution of certain matters to be resolved by the Board of Directors. The Representative Director and Directors in charge of business execution are granted with approval authority with regard to decision-making duties. Audit & Supervisory Board Members also attend the meetings to audit business execution.

The Board comprises Directors with diverse backgrounds and a wealth of knowledge, including Executive Directors well-versed in our business and highly independent Outside Directors who have a wealth of experience and knowledge in finance and are capable of giving appropriate advice on fair resolution and overall management. The Board is chaired by President & Representative Director.

The Board is chaired by President & Representative Director.

Audit & Supervisory Board

The Audit & Supervisory Board consists of four Audit & Supervisory Board Members (three of whom are Outside Audit & Supervisory Board Members), one of whom is full-time Audit & Supervisory Board Member. According to the audit plan, each Audit & Supervisory Board Member rigorously audits Directors' execution of duties based on their respective roles. The Audit & Supervisory Board meeting is held once a month in principle. The Board is chaired by a full-time Audit & Supervisory Board Member.

Under the audit policies and audit plan developed by the Audit & Supervisory Board, the full-time Audit & Supervisory Board Member attends important meetings, such as the Board of Directors meeting and the Management Meeting; conducts interviews with and receives reports from each department as necessary; and thereby audits Directors' execution of duties regarding overall management and individual matters.

Management Meeting

As a body to discuss important matters on management, including matters to be resolved by the Board of Directors, and to resolve matters entrusted by the Board of Directors, the Management Meeting is held weekly, in principle, and also when necessary. We thus strive for speedy business operations. The Management Meeting consists of full-time Directors, full-time Audit & Supervisory Board Member, and Executive Officers. The Management Meeting is chaired by President & Representative Director.

Nomination and Compensation Committee

To enhance fairness, transparency, and objectivity of the procedures for the nomination of Directors and decisions on their compensation, as well as for the nomination of Audit & Supervisory Board Members, the Nomination and Compensation Committee gives advice and makes recommendations in response to requests for consultation from the Board of Directors. The Committee consists of three Directors, two of whom are independent Outside Directors. The Committee is chaired by an independent Outside Director.

Risk Management Committee

The Risk Management Committee deliberates on matters concerning overall risk management. The Committee meeting is held monthly, in principle, and also when necessary. The Committee consists of full-time Directors, full-time Executive Officers, General Manager of Corporate Planning Division; and Risk Management Division. The full-time Audit & Supervisory Board Member also attends the Committee meeting to review the status of implementation of risk management systems. The Committee is chaired by President & Representative Director.

Compliance Committee

The Compliance Committee deliberates on important matters concerning policies and system development for promoting compliance. The Committee meeting is held monthly, in principle, and also when necessary. The Committee consists of full-time Directors, full-time Audit & Supervisory Board Member, Executive Officers, and General Managers of Corporate Planning Division; Operations Management Division; Risk Management Division; General Affairs Division; and Audit Division. The Committee is chaired by President & Representative Director.

Information Security Committee

The Information Security Committee deliberates on matters concerning policies and system development for promoting information security measures and decisions on specific measures. The Committee meeting is held monthly, in principle, and also when necessary. The Information Security Committee consists of the Information Security Management Officer, served by the Director in charge of the Operations Management Division, the Personal Information Protection Management Officer, General Managers of Corporate Planning Division, Systems Division, Risk Management Division, and Operations Management Division. The General Manager of Audit Division also attends the Committee meeting, and audits the status of compliance with rules and regulations related to information security. The Committee is chaired by the Director in charge of Operations Management Division (Information Security Management Officer).

Diagram of corporate governance system

Compliance

Basic Stance

To maintain solid trust and credit from customers and society, ensuring compliance is set forth as part of our management policy. Considering the highly public nature of the credit guarantee business we are engaged in, realizing compliance is a basic premise of all corporate activities, and we believe that each and every officer and employee needs to make sure that they put it into practice in their day-to-day work.

Compliance Practices

The Board of Directors prepares a Compliance Program for each fiscal year as a specific action plan for educating officers and employees and monitoring compliance-related matters in business operations, and ensures thorough compliance under the supervision of the Compliance Committee.

Also, the Company distributes the Compliance Manual, which contains basic compliance guidelines and rules, and Compliance Case Studies, which summarizes key points based on examples from business operations, and conducts monthly compliance training for all employees to promote better understanding and raise awareness of compliance among employees.

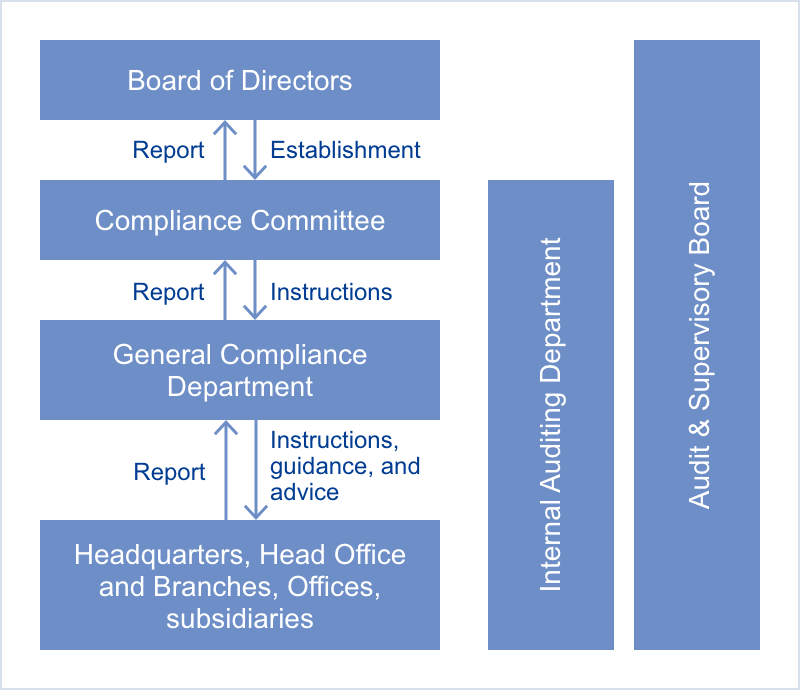

System for implementing compliance

The Compliance Committee, chaired by President & Representative Director, has been established under the Compliance Regulations. The Committee monitors the status of implementation of the compli- ance program, developed by the Board of Directors every fiscal year; discusses and determines important matters concerning compliance; and make regular reports to the Board of Directors.

As the General Compliance Department, Legal Office of Operations Management Division oversees all matters concerning compliance, make reports to the Compliance Committee, and give instructions, guidance, and advice to each department.

In addition, head of each department is responsible for managing and practicing compliance in each department.

System for implementing compliance

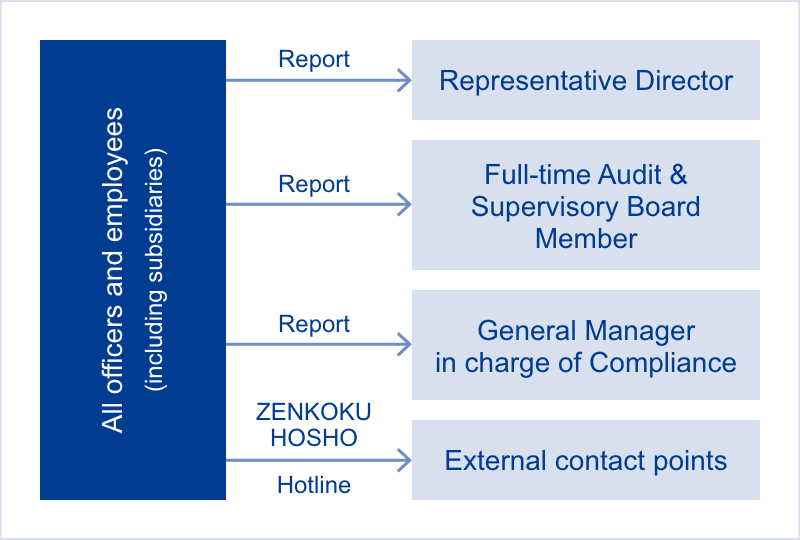

Whistle-blower system

The Company has established a whistle-blower system in order to promote compliance management and early detect and rectify information on managerial risks. The system is available for all officers and employees regardless of employment status (including officers and employees who retired within a year). In addition to the facts subject to whistle-blowing as stipulated in the Whistleblower Protection Act, a wide range of other issues are accepted, including violations of laws and regulations, human rights violation, labor issues, and compliance issues.

There are three whistle-blower contact points internally and two externally to ensure independence. The system allows users to report anonymously as well as under their real name so that officers and employees can use the system with ease. In addition, the Whistle-blower Regulations provide for measures that prohibit the search and disadvantageous treatment of those who reported or cooperated in investigations and other rules so that officers and employees can make reports with peace of mind. Furthermore, the Company provides ongoing education through in-house training programs and distributes a card to be carried by employees that describes the whistle-blower contact points and how to use the system, to ensure that reporting is done appropriately. When a report is made, General Manager in charge of Compliance and the department in charge conduct an investigation and report the results of the investigation and corrective measures to the Compliance Committee and the Board of Directors. The Company receives advice from external law firms in each of the deliberation processes to formulate preventive measures to ensure the appropriateness of the measures.

The system's structure, operation and effectiveness are verified at the Board of Directors, Compliance Committee and through compliance awareness surveys for employees.

The above system is common to the entire Group. The Company, which is the headquarters of the Group, directly receives reports from subsidiaries to early rectify and prevent issues at the subsidiaries.

Whistle-blower contact points

Prevention of bribery and corruption

Our Corporate Code of Ethics, Code of Conduct, and Compliance Manual stipulate that we shall maintain a sound and good relationship with society and shall not entertain or give gifts to clients beyond business practices. We thus strive for thorough prevention of bribery and corruption.

To eliminate bribery from the business we engage in and ensure fair business execution, we also ask for our business partners' understanding of and cooperation with compliance with anti-bribery laws and regulations and our stance on the matter.

Our Approach to Anti-Bribery and Corruption (Excerpt)

-

Entertainment and gifts

We will not provide entertainment, gifts, or favors beyond the bounds of business practice, either as a company or as individual officers and employees, and we will strictly refrain from any behavior that might raise suspicion. Also, we will not give or receive any entertainment, gift, or favor for the purpose of obtaining or maintaining any unfair advantage or preferential treatment.

-

Relationship with government employees and quasi-government employees

We will comply with the National Public Service Ethics Act, the National Public Service Ethics Code, and other similar rules and regulations established by each public agency for government employees and other public officials, and will refrain from any behavior that might raise suspicion of being in conflict with such rules and regulations.

-

Prohibition of conflicts of interest

We will not engage in any dishonest acts such as using company money or goods for personal use, improperly giving or receiving money or goods from business partners or customers, or using our positions in the company for personal benefit or receiving gifts in connection with our duties.

Political contributions

Contributions to support the activities of political organizations will be handled appropriately in accordance with laws and regulations, as well as internal regulations. We have not given any political contributions or donations to political organizations in the past five years.

Basic Policy against Antisocial Forces

ZENKOKU HOSHO declares the following basic policy to prevent damage caused by groups or individuals who pursue economic benefits by using violence, force, and fraudulent methods (so-called antisocial forces).

- We shall not have any relationship with antisocial forces.

- In order to prevent damage caused by antisocial forces, We shall cooperate with external specialist organizations such as police and lawyers, and deal with such forces in a systematic and appropriate manner.

- We shall not accept any unreasonable demands from antisocial forces and shall take firm and legal action.

- We shall not provide funds or engage in backroom deals with antisocial forces.

- We shall ensure the safety of officers and employees who respond to unreasonable demands from antisocial forces.

Protection of Personal Information

Basic Stance

We have established the Basic Policy on the Protection of Personal Information regarding the appropriate protection and use of personal information. Based on the Act on the Protection of Personal Information and guidelines for the protection of personal information, we ensure that customers' personal information is handled under strict control.

Personal information management system

In light of the importance of protecting personal information, we consider it necessary to build and develop a systematic personal information protection system more stringent than the Act on the Protection of Personal Information. Accordingly, we establish, implement, maintain, and improve a personal information protection management system that conforms to JIS Q 15001 (2017)※1. As a result, we have been authorized to use the PrivacyMark※2.

Through distribution of manuals on the protection of personal information to all officers and employees, as well as periodic checks on the level of understanding, we not only ensure thorough awareness of the matter but also strengthen the readiness for each person to proactively think, act, and protect personal information. In addition, all employees are obligated to obtain the qualification of personal information handling supervisor, certified by the Japan Consumer Credit Association.

※1A personal information protection management system (PMS) refers to a set of management systems where internal regulations are established to protect personal information, personal information is handled in accordance with the regulations, and the status of handling is audited and reviewed on a regular basis to continuously improve and increase the accuracy of the handling of personal information.

※2JIPDEC accredits organizations that have established PMSs in accordance with JIS Q 15001 (2017) and have developed feasible systems based on the PMSs, and are certified to be handling personal information appropriately. Such organizations are authorized to use the mark.

Risk Management

Basic Stance

We believe that if a guarantee company is to secure the soundness and appropriateness of its operations, it needs to develop and establish a risk management system that allows it to respond to a range of risks.

Regarding the risks concerning our business operations, we identify, quantify, monitor, and control the risks and set out policy and management system, thereby aiming to ensure the effectiveness of our risk management and soundness of our business.

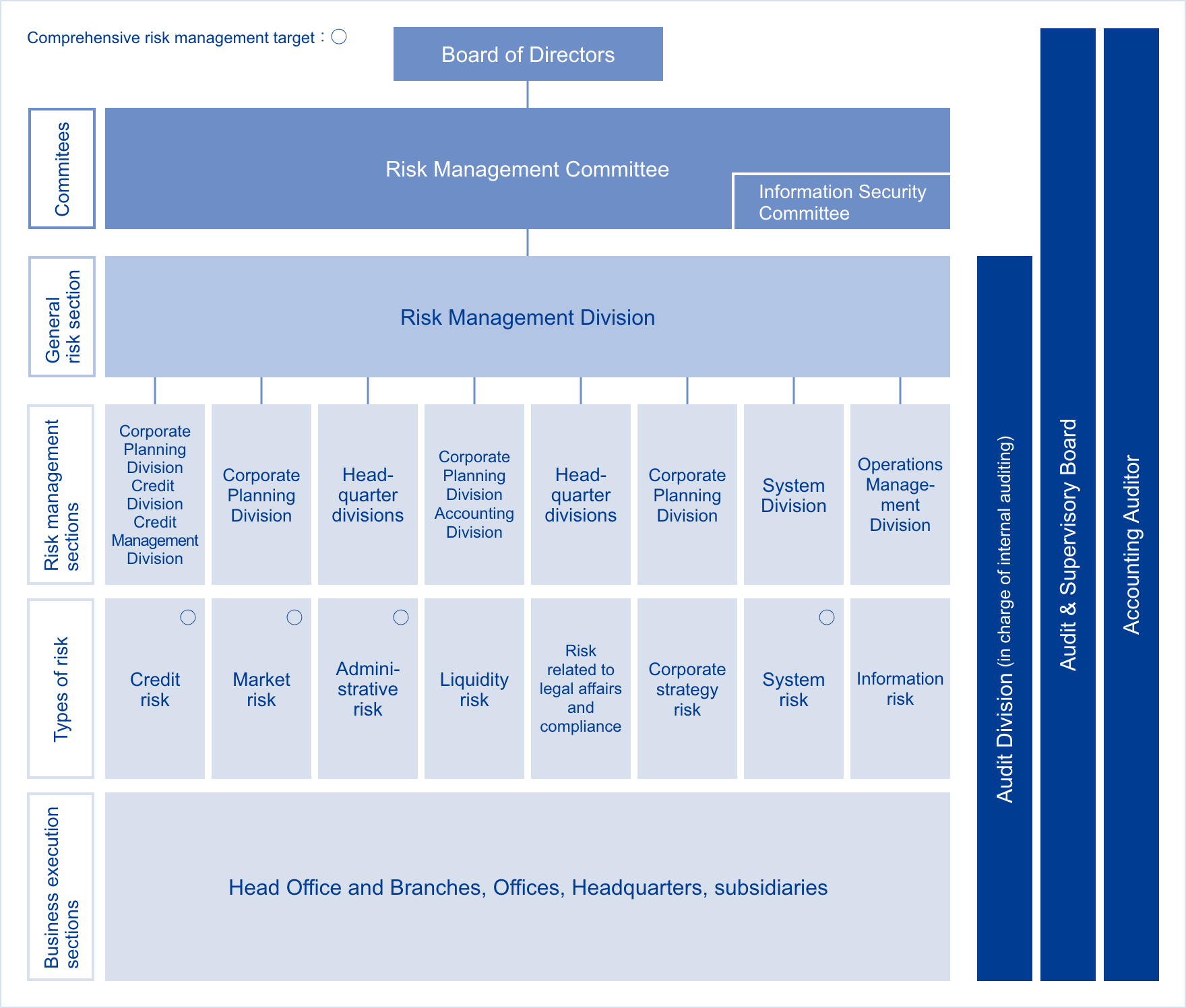

Risk management system

In the course of business operations, we face a variety of risks. These risks need to be centrally managed, rather than just individually, in order to maintain the growth of profitability and soundness of business management.

As a way to appropriately manage risks, we designate a risk management section responsible for each of the risks inherent in our corporate operations, based on the Risk Management Regulations laid down by the Board of Directors, and the risks are collectively overseen by the Risk Management Division as the General Risk Department.

The Risk Management Committee established by the Board of Directors, upon receiving report from the General Risk Department, investigates the circumstances in which the risk has occurred, the conditions of its management, and the status of risk management system, and also deliberates each individual case, considers specific methods of control, and reports to the Board of Directors.

The Audit Division identifies audit matters related to risk management before carrying out internal audit, and verifies the effectiveness of risk management and its administrative functions, along with external audit conducted as needed.

Under this risk management system, we are making every effort to appropriately manage the diverse risks and ensure sound corporate management.

Diagram of risk management system

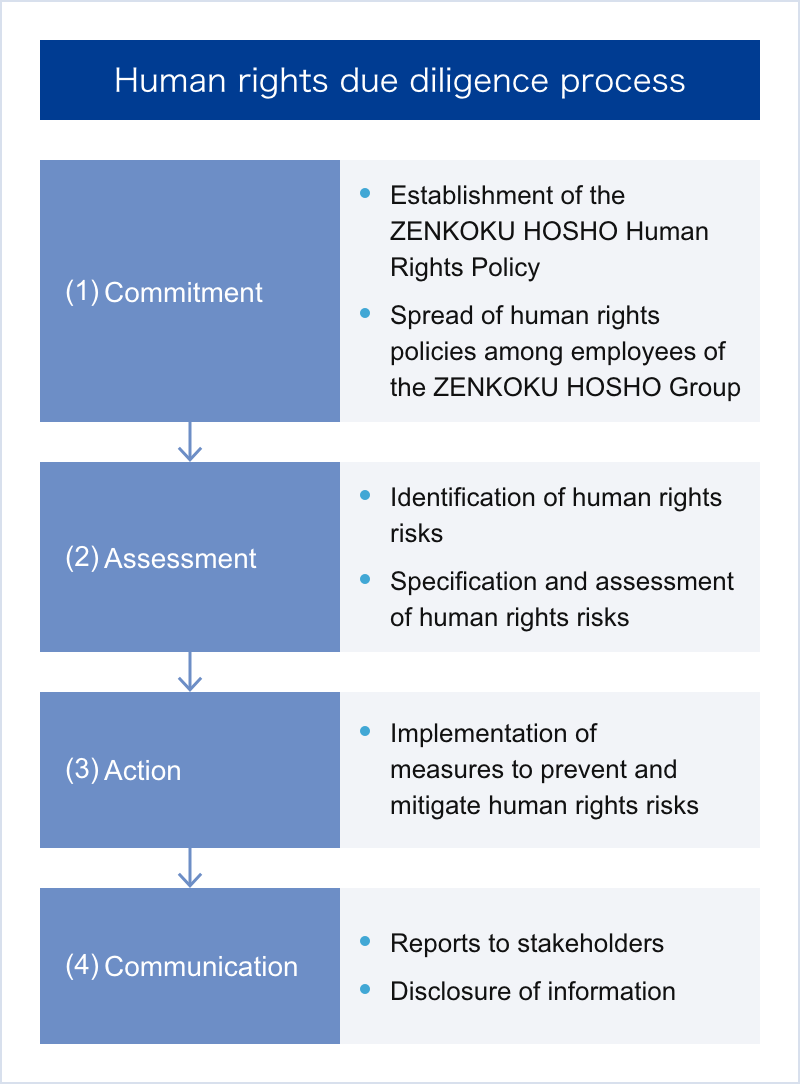

Initiatives Concerning Respect for Human Rights

Basic Stance

Recognizing that respect for human rights is a social responsibility, the Group has established the ZENKOKU HOSHO Human Rights Policy, and we are promoting efforts to respect human rights in order to fulfill our responsibility to respect human rights across our business activities as a whole.

Concrete measures

In accordance with the United Nations' "Guiding Principles on Business and Human Rights" and other standards related to human rights, the Group has established the ZENKOKU HOSHO Human Rights Policy, and we are promoting efforts to respect human rights, including support for the recognition of freedom of association and collective bargaining, the elimination of forced labor, the securing of minimum wages, the abolition of child labor, and the elimination of discrimination in employment and occupation.

Our Human Rights Policy applies to all officers and employees in the ZENKOKU HOSHO Group, and we expect our business partners to share the views set forth in this policy and respect human rights. We will also fulfill our responsibility to respect human rights by preventing, reducing, and relieving the negative impact of our business activities on human rights.

In the event that the Group is found to be causing or contributing to a negative impact on human rights, we implement appropriate remedies and corrections. In addition, we provide an inquiry form on our website, and have set up telephone contacts and whistle-blower contact points, thereby creating a system for accepting consultations by various methods.

We will also encourage our business partners to take appropriate measures if they are having a negative impact on human rights.

In order to fulfill our responsibility to respect human rights, we will continue to conduct human rights due diligence and promote efforts to respect human rights through dialogue with stakeholders.

In FY2023/3, we conducted five training sessions related to respect for human rights.

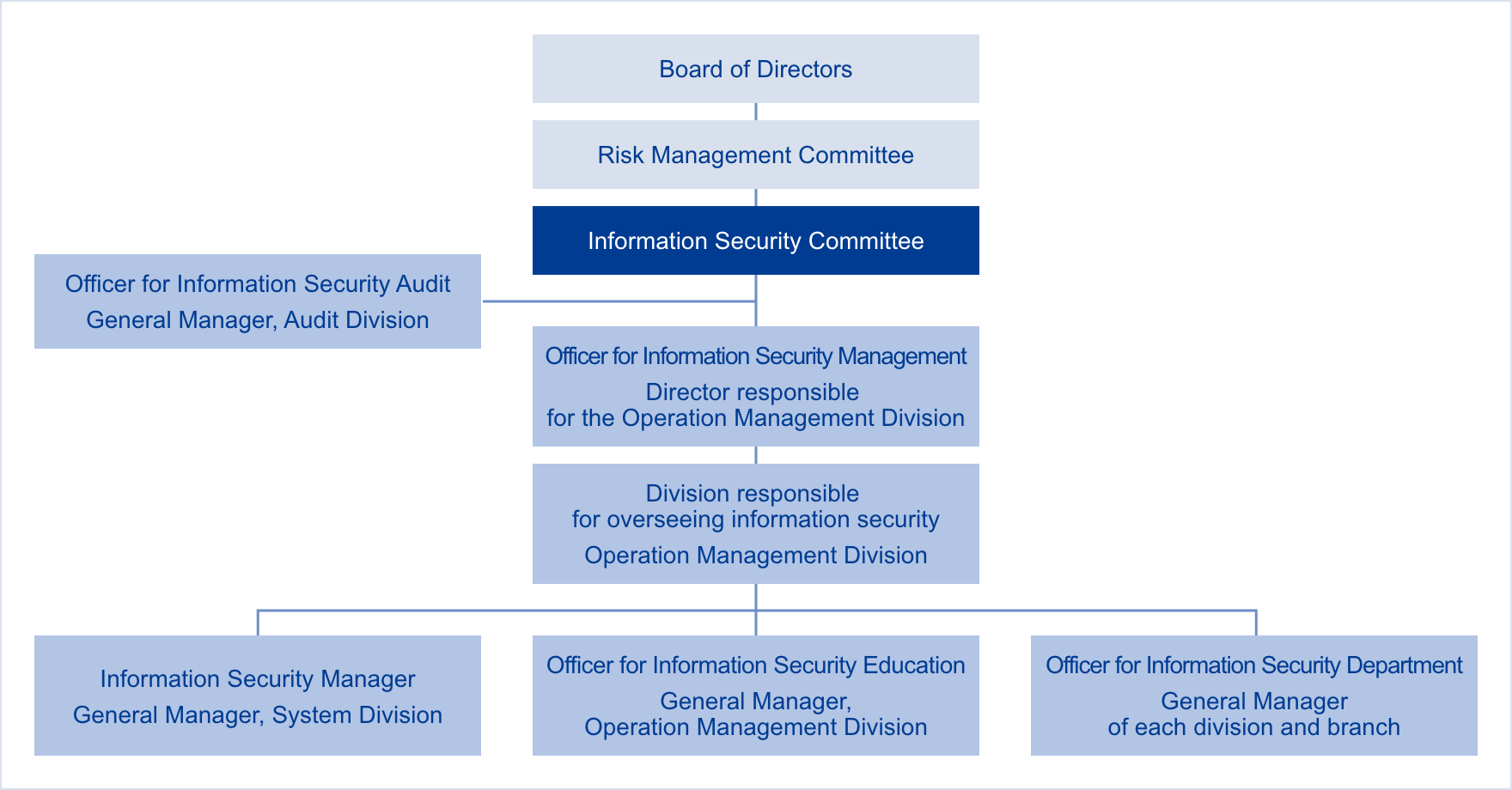

Information Security

Basic Stance

When conducting our business activities, the ZENKOKU HOSHO Group recognizes that maintaining and improving our information security management system is an important management issue for protecting our information assets from all types of threats, and ensuring the confidentiality, integrity, and availability of information assets.

We have established a "Basic Policy on Information Security" as a guideline for our initiatives.

Concrete measures

In order to protect information assets from various threats and appropriately manage them, we have established regulations and management systems related to the handling of information assets.

We have established the Information Security Committee as a permanent body, which deliberates matters related to the development of policies and systems for promoting information security measures and the determination of specific measures. In principle, the Committee meets once a month and as necessary.

The members of the Information Security Committee consist of the Officer for Information Security Management and the Officer for Personal Information Protection Management, both of which are fulfilled by the Director responsible for the Operation Management Division, as well as the General Manager of the Corporate Planning Division, the General Manager of the System Division, the General Manager of the Risk Management Division, and the General Manager of the Operation Management Division.The General Manager of the Audit Division also attends meetings of the Committee to audit compliance with regulations related to information security, etc. The Committee is chaired by the Director in charge of Operations Management Division (Information Security Management Officer).

Diagram of information security system

Crisis Management

Basic Stance

Our definition of crisis covers large-scale natural disasters, fire and other accidents, widespread infectious diseases, system failures, leakages of personal information, and other events that cannot be coped with within the scope of ordinary risk management. We believe that exercising thorough disaster and crisis management and developing and establishing crisis management systems such as those for business continuity in preparation for such crises will maintain our external confidence and contribute to our existence as a company.

Concrete measures

We have established crisis management regulations and manuals aimed at preventing crises, protecting the safety of our employees in the event of a crisis, and bolstering the system for the company's business continuity (recovery).

At normal times, we are taking various measures in anticipation of all kinds of possible crises, including implementation of training and drills aimed at raising the employees' awareness of disaster prevention and enhancing their readiness in the event of a crisis.

In the event of a serious crisis that causes our operations to halt, we will set up a crisis management headquarters and take primary response actions such as gathering information including on the safety of staff and the damage, and then work out and implement a recovery plan so as to quickly bring our business operations back to normal.

Initiatives for Shareholders and Investors

Improving IR activities and information disclosure

We are striving to deepen the understanding of our business and performance among our shareholders and investors, with whom we aim to have more dialogues. For sell-side analysts and institutional investors, we hold financial results briefings, small meetings, and personal meetings, while for individual investors, we host company information briefings. To bring the content of these briefings to a wider audience, we offer videos and materials on our website. Insights and opinions gathered at the dialogues with our shareholders and investors are reported to and shared by the Board of Directors once every quarter.

We are also working to disclose more information through our integrated report, shareholder newsletter, and website.

Corporate Code of Ethics and Code of Conduct

Basic Stance

The Group has established a Corporate Code of Ethics and a Code of Conduct to provide standards of judgment and conduct for individual officers and employees.