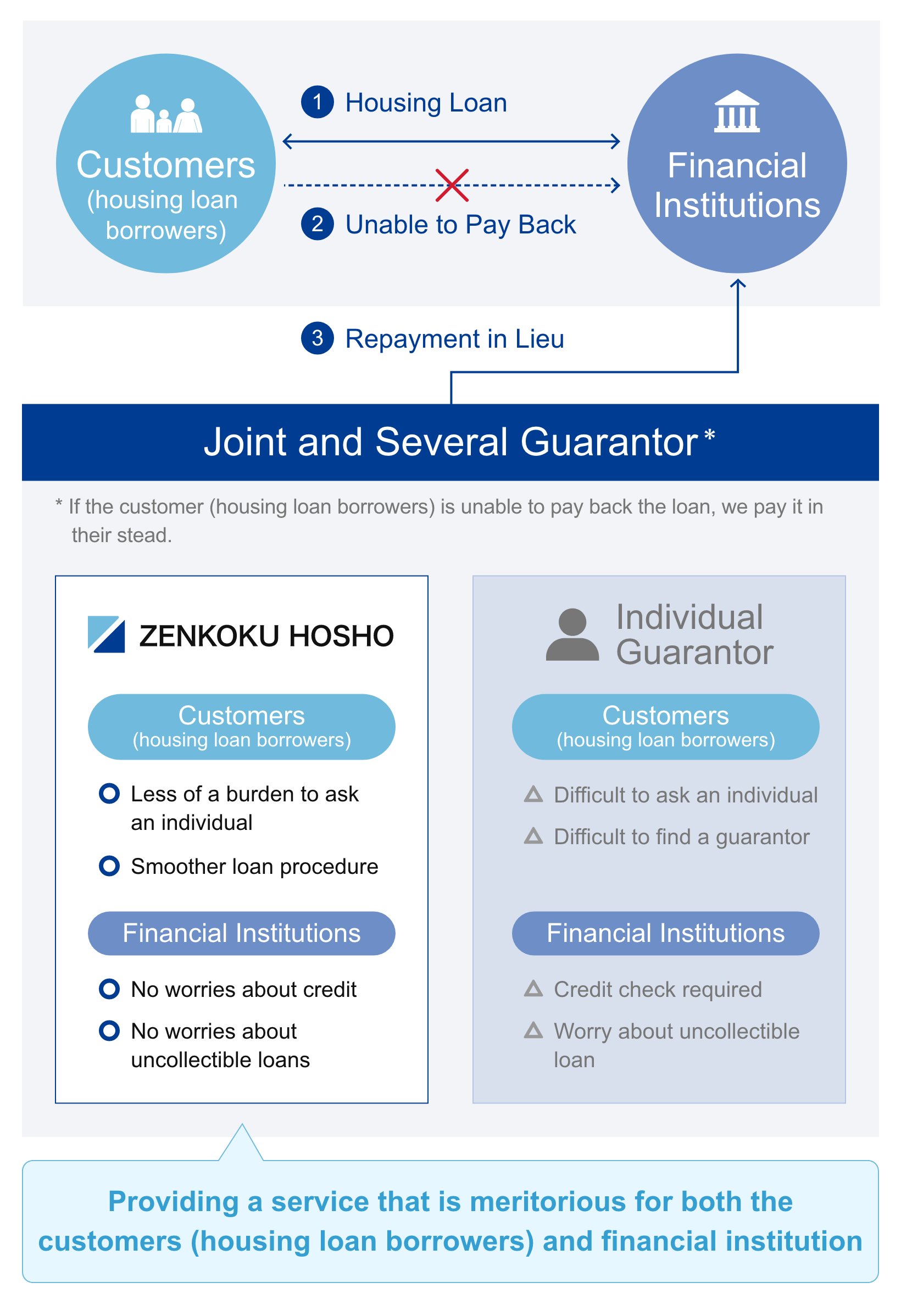

The Role of a Guarantee Company

In Japan, most people who purchase houses use housing loans. Many housing loans are for very large sums of money and last for a very long time, and so it is common for financial institutions to set the real estate in question as collateral, and to require a joint and several guarantor as a prerequisite for granting the loan. In the past, parents or siblings would serve as the joint and several guarantor for the housing loan borrower. But it is not often easy to ask an individual to act as your guarantor. That is where guarantee companies like ZENKOKU HOSHO come in. The customer (housing loan borrowers) can use our services to make the procedures for applying for loans from financial institutions more smoothly.

For financial institutions, as well, our acting as joint guarantor means a reduced risk of their becoming unable to collect on their housing loans, which allows them to provide loans with confidence.

In this way, ZENKOKU HOSHO provides a credit guarantee service that is meritorious for both the customer (housing loan borrowers) and financial institution, which supports the activation of housing loans and fulfills an important role in society.

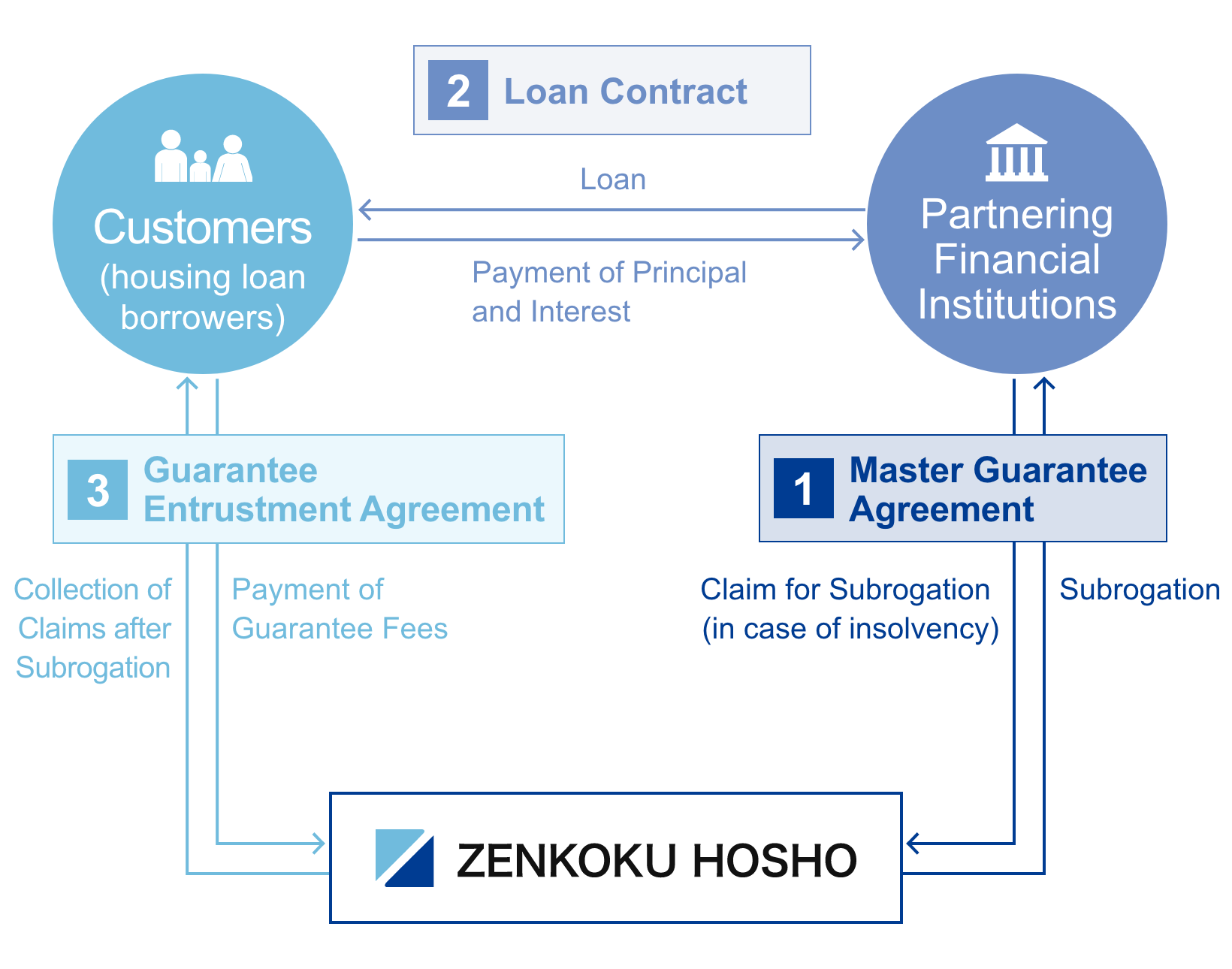

ZENKOKU HOSHO's Business Model

The customer (housing loan borrowers), through their financial institution, makes an application to ZENKOKU HOSHO for a guarantee, and we perform a guarantee examination. If, as a result of the guarantee examination, we decide to grant the guarantee and the loan application is successful, then we receive a guarantee fee and administrative fee from the customer (housing loan borrowers), as consideration for the joint guarantee, and the joint guarantee is initiated.

In the event that the customer (housing loan borrowers) becomes unable to pay the loan back to the financial institution, ZENKOKU HOSHO pays the remaining amount of the loan back to the financial institution in their stead. This is called "subrogation." After the subrogation is made, the customer (housing loan borrowers) enters into discussions with ZENKOKU HOSHO in order to return the payment to us. This is, from ZENKOKU HOSHO's perspective, called "debt collection," and this is primarily accomplished by selling the mortgaged home.

Relationship Diagram of Credit Guarantee Services for Housing Loans

- Since a housing loan is generally large with a longer repayment period, a joint and several guarantor is required.

- However, as a joint and several guarantor shall be onerous in the event of the insolvency of the principal loan holder, ZENKOKU HOSHO can offer effective services for borrowers of housing loans.

- 1Master Guarantee Agreement

- Master guarantee agreements shall be concluded by and between ZENKOKU HOSHO and each financial institution. This agreement defines an acceptance of guarantee and subrogation.

- 2Loan Contract

- Loan contract shall be concluded by and between each borrower and the lending financial institutions. This contract defines a loan amount, interest rate, lending period and other conditions of each loan.

- 3Guarantee Entrustment Agreement

- Guarantee Entrustment Agreements shall be concluded by and between each borrower and ZENKOKU HOSHO. Pursuant to the agreement, ZENKOKU HOSHO will act as joint and several guarantor for the housing loan.